Bibance Coin (BNB) trades at $247, up 5.5% over the last 24 hours with a daily trading volume of $882 million. BNB, the token that powers the Binance Smart Chain (BSC), has risen 0.45% over the past week and is currently trading 3% above its level 30 days ago.

The token has, however, had a rough start to the year as it faces increased regulatory scrutiny globally. This coupled with the effects of the 2022 “crypto winter” has seen Binance Coin drop 23% over the last three months and 13.2% over the last six months.

With a market capitalization of $38.4 billion, BNB remains the fourth largest cryptocurrency by market capitalization, according to data from CoinMarketCap.

Even though there is a bearish sentiment around the BNB token at the moment, the long term sentiment in the crypto market remains bullish.

In this article, we lay out possible price targets and projections for Binance Coin. But first we have a brief overview of BNB, what is and what developments have taken place in its ecosystem.

Binance Coin (BNB) Overview

Binance Coin (BNB) is the native cryptocurrency for the BNB Chain ecosystem. It was originally built on the Ethereum network as an ERC-20 token, but now powers Binance’s powerful ecosystem. BNB is the utility token for the Binance Exchange ecosystem and is used to pay for trading fees on the platform.

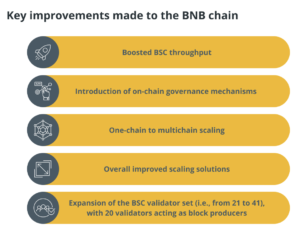

BNB Chain was birthed when the Binance Chain was merged with the Binance Smart Chain (BSC). The BNB chain was designed to power the world’s first parallel virtual ecosystem. It renders itself to an open, multi-chain, permissionless and decentralized platform for developers and investors.

BNB is an integral part of the successful functioning of this virtual space.

BNB Evolution

Binance Coin (BNB), which stands for “”Build and Build”, was first distributed by Binance through an initial coin offering (ICO) on the Ethereum blockchain in July 2017. Binance is the largest crypto exchange by trading volume and was co-founded by CEO Changpeng Zhao, aka CZ, a Chinese-Canadian business executive.

During the ICO, half of the 200 million allocation went up for public sale, while a large portion of 50% was kept aside for the founding team and angel investors, albeit vested over a four-year period. The ICO raised $15 million.

Here is a sneak preview into BNB’s timeline:

- February 2019 – Binance launched the DEX testnet for the new era of peer-to-peer (P2P) cryptocurrency trading.

- April-2019 – The company launched the Binance Chain mainnet with pre-selected validators producing blocks.

- April 2019 – The ERC-20 mainnet swap took place, with the Binance Coin migrating from Ethereum to the Binance Chain under the newly designed BEP2 standard. BNB coins were swapped for BEP2 tokens.

- September 2020 – Launch of the Binance Smart Chain (BSC).

- December 2021 – The BNB Auto-Burn, a new protocol for the quarterly BNB burn, was introduced.

- February 2022 – The BNB Chain was introduced. This is Binance’s smart contract platform, where developers can deploy their own digital assets.

Other Key Binance Developments

Since BNB is the utility token of the Binance ecosystem, any development with the network usually affects the BNB price in some way. Understanding the major developments that Binance has gone through is vital to gaining insights into BNB’s price journey.

Here’s a look into some of Binance’s key developments in recent years:

- 2020 – Binance acquired CoinMarketCap, one of the most visited crypto price-tracking websites in the world. Binance also acquired Swipe, a leading multi-asset digital wallet and Visa debit card platform. In September of that year, Binance launched Liquid Swap, a trading platform that hosts different pools of liquidity, allowing users to exchange crypto assets and earn from their pooled funds. At the end of 2020, the exchange launched the Combined Convert & OTC Trading Portal and entered into a new strategic partnership with Chiliz, marking its entry into the fintech sports space.

- 2021 – Metamask added built-in PancakeSwap’s swap feature, enabling users to access BNB Chain tokens seamlessly. Deri Protocol launched the first permissionless derivatives market on the BNB Chain in August. In September, PowerPool, the first BNB Chain DeFiIndex, went live on BNB Chain. The chain surpassed 100 million unique addresses in October. A revolutionary BNB Chain v1.1.5 upgrade called Bruno, with BEP95 real-time burn mechanism, was deployed on BNB Chain Mainnet in November. Chainlink Keepers was launched and Ankr implemented the Erigon client to the BNB Chain Mainnet in December.

- 2022 – Binance partnered with Ledger to enable even smoother crypto purchases and in December, Binance Pay partnered with Pyypl to bring users a more secure online transaction experience.

BNB Price History

The Binance Coin (BNB) was created in 2017, shortly after the Binance crypto exchange was founded by Changpeng Zhao. According to Zhao, the BNB coin sales served as the sole funding to support the development of the exchange.

BNB was introduced through an initial coin offering (ICO) and swiftly gained recognition as one of the most successful ICOs during that period.

During the ICO in June and July 2017, the BNB coin was priced at approximately $0.11, calculated in ETH or BTC. Subsequently, its first recorded price on CoinMarketCap was $0.1015.

Remarkably, in less than six months after its launch, in December 2017, the value of BNB surged to $9. Note that BNB was launched at the height of the 2017 crypto market bull run and it recorded an over 2280% rally between July and December that year.

Over the following months, BNB stabilized within the range of $10 to $20, the value that characterized the exchange token during the 2018 bear market. The price rose 900% from $6 in January 2019 to reach $43 in June 2019, before subsequently fluctuating between $10 and $20 for the rest of the year..

In September 2020, the Binance Smart Chain (BSC) was introduced, along with a BEP-20 version of BNB. BSC was developed as a fork of Ethereum, where the open-source Ethereum code was modified to align with their specific objectives.

The introduction of BSC brought lower fees and faster transaction speeds, captivating users and developers alike, and propelling BNB to become one of the most dynamic cryptocurrencies. This extraordinary growth led to its all-time high (ATH) of $704 in May 2021. This marked a 3811% climb that defined the 2021 bull market for the BNB coin.

BNB/USD All-time Chart

After reaching its all-time high (ATH), the price of the token that powers the Binance ecosystem experienced a rapid decline, briefly rebounding to $279 before attempting a brief recovery. Nonetheless, following the broader trend in the cryptocurrency market, Binance Coin’s value started to depreciate as the 2022 bear market took a toll on crypto prices, reaching a low point of $183 in June.

After touching the $183 mark, BNB entered a period of consolidation, oscillating between the $215 and $350 range. However, recent developments have adversely impacted its value, particularly with the SEC’s lawsuit against Binance, alleging the sale of unregistered securities, mishandling of customers’ funds, and operating a “web of deceptions”.

As a result of these legal challenges, there has been a significant drop in the price of BNB, witnessing a 29% decrease over the past couple of months and a substantial 65% decline from its all-time high.

At the time of writing, Binance coin was exchanging hands at $248.

BNB Weekly Price Analysis

The Binance Coin price action since April 2022 had led to the appearance of a symmetrical triangle on the weekly chart. This pointed to a massive move in either direction once the triangle is confirmed.

In early June the SEC lawsuit against Binance increased overhead pressure on BNB price which plunged as much as 25% during the first week, dropping below the triangle. This sell-off was halted at the 200-weekly simple moving average (SMA) which has been supporting the price since then.

Note that a daily candlestick close below this dynamic support which currently lies at $233 would set BNB price on free fall toward the pessimistic target of the governing chart pattern at $100. Such a move would represent a 58.7% descent from the current price.

BNB/USD Weekly Chart

Over the past five weeks, BNB has been consolidating above the 200 SMA. This is supported by the flattening of the SMAs as well as the sideways movement of the relative strength index (RSI). This suggested that the bulls are aggressively defending the support provided by the 200-day SMA.

As such, increased demand pressure from this level could see the Binance Coin price above the triangle’s support line at $270. This move could see the price consolidate within the triangle for a few weeks.

A rise higher could see BNB break the 50 SMA at $290. This would bolster the bulls who could push it above the triangle’s resistance line at $305, confirming a bullish breakout from the technical formation.

If this happens, BNB could rise to confront resistance from the 100 SMA at $350. Breaching this level could see Binance Coin rise to first toward the $450 major resistance level, before climbing higher to hit the bullish target of the governing chart pattern at $500. This would represent a 106% ascent from the current price.

BNB Short-term Price Prediction: Can BNB Hit $1000 in 2023?

The recent lawsuit filed by the SEC poses a significant challenge for the BNB coin. It adds to the many regulatory challenges the exchange has been facing around the globe. A primary selling point of BNB is its close association with the Binance exchange. If Binance is unable to operate within the US or any other major world economy, a substantial portion of liquidity could be lost from the BNB ecosystem.

Considering the coin’s existing downtrend and regulatory uncertainties, it appears unlikely for Binance to recover its losses this year. The SEC’s legal actions against Binance are expected to extend for a long period – if the Ripple v. SEC case is anything to go by, leading to much speculation about how the case will unfold, thereby influencing the coin’s price.

Given these factors, our overall fundamental outlook for the BNB coin is bearish/neutral for this year. It is important to monitor the BNB price chart and the associated technical indicators to determine potential price targets.

As mentioned earlier, BNB is cruelty trading around a crucial support level, and a break below this level could have severe consequences for the coin. In light of the unfavorable short-term fundamentals for BNB, the possibility of a price break below the support level remains significant.

However, considering the expected uptick in the crypto markets in 2024, we anticipate BNB to temporarily breach the support level and then retrace back to its present range in Q1 2024.

What this means is that BNB $1,000 in 2023 is farfetched. For this to happen, the value of BNB may increase by 30% in order to reach $ 906.34 by 2050.

| Month | Predicted Price |

| July | $250 |

| August | $325 |

| September | $423 |

| October | $549 |

| November | $714 |

| December | $928 |

However, given the current conditions, it is highly unlikely that Binance Coin price will increase by 30% month-on-month.

With this in mind, our BNB price prediction estimates an average price of $250 for the month of July with a possibility of stabilizing around $170. The above weekly price analysis also points to a potential low of 100 and a possible high of $500 before the end of 2023.

BNB Price Long-term Price Prediction

Despite the EU’s progress in establishing Market in Crypto Assets (MiCA) regulations, the crypto industry still faces a considerable level of regulatory uncertainty. Consequently, making long-term price predictions, especially for BNB, which is closely linked to the Binance centralized exchange (CEX), becomes challenging.

However, if Binance manages to secure agreements with regulators, BNB has the potential to be among the top-performing coins in the long run. This is due to Binance’s prominent role as the go-to platform for retail investors to enter the blockchain space by converting fiat to cryptocurrencies.

Notably, many crypto investors begin their journey on a CEX before exploring non-custodial transactions and setting up crypto wallets. In this context, BNB enjoys a favorable position for mass adoption, as Binance serves as the primary gateway for most people to make their initial digital currency purchases.

Moreover, with considerably lower fees than Ethereum, Binance Smart Chain (BSC) emerges as a more accessible option for novice crypto users to start their crypto ventures.

Furthermore, Binance offers the Binance Academy, an educational platform that facilitates the onboarding of users into the world of cryptocurrencies. While there are currently 2 million BNB holders, Binance’s extensive user base comprises over 30 million users worldwide.

As the cryptocurrency market continues to attract more investors, and Binance users become increasingly familiar with blockchain technology, the number of BNB holders is likely to expand significantly, resulting in potential price appreciation for BNB over time.

According to our long-term price prediction input into the Binance price prediction calculator, if the value of BNB increases by 30% it might reach $1,000 in 2028 and cross the $1,500 mark in 2030. If this consistency remains, the Binance Coin price might get to $5.400 by 2040.

| Year | Predicted Price |

| 2023 | $250 |

| 2024 | $325 |

| 2025 | $423 |

| 2026 | $549 |

| 2027 | $714 |

| 2028 | $928 |

| 2029 | $1,207 |

| 2030 | $1,569 |

| 2040 | $5,400 |

Bottomline

Although BNB could climb higher, traders should remember that the crypto market is usually characterized by extreme price volatilities triggered by different factors including macroeconomic conditions, geopolitical issues, internal fundamentals and general market sentiments and emotions.

In addition, BNB’s centralized nature presents several risks, ranging from regulatory issues to censorship and negative community sentiment. Therefore, while BNB holds promising long-term potential, it also faces substantial risks of a price collapse caused by regulatory pressures and concerns regarding centralization.

Binance has managed to maintain BNB’s price relatively effectively thus far, but this may not always be sustainable, especially considering the likelihood of more Fear, Uncertainty, and Doubt (FUD) arising in the future.